Avoiding Lawsuits

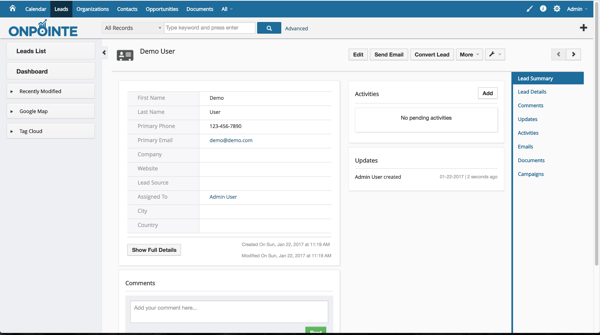

Most people use a CRM system because it will help them stay organized and make more sales.

Both are good reasons to use a CRM, but the most overlooked reason to use a CRM is because using one can help you AVOID lawsuits.

The creator of OnPointe CRM, Roccy DeFrancesco, is an attorney who understands what it takes to avoid lawsuits in general, and specifically in the financial services and insurance industries.

We live in a very litigious society. Professional negligence can have a very long shelf life due to the tolling of the statute of limitations to a time when the client should have reasonably known of the negligence.

For example: An insurance agent could sell a life insurance policy 4-6-8+ years ago and still have a lawsuit filed for negligence today. It is vital to have copies of all correspondence with clients. In the age of emails, far too many emails are being deleted and not kept in a file for future use.

Every substantive email sent to a client should be sent from or at least recorded in the CRM system.

The recorded electronic paper trail of client correspondence can be the difference between success and victory in a lawsuit.

If you take nothing else from surfing this site, take from it us that you MUST use a CRM to protect yourself (whether that’s OnPointe CRM or some other program).

OnPointe Risk Analyzer (click here to learn more)

In addition to using a CRM to avoid lawsuits, using our OnPointe Risk Analyzer can help mitigate your liability when making recommendations to clients.

The DOL fiduciary regulations essentially mandate that advisors do an investment risk tolerance assessment of each client. Advisors can do that on their own and try to keep a record of it in the CRM or they can use OnPointe Risk Analyzer. The benefits of using a 3rd party program is that the software is unbiased and creates a risk score based on the client’s inputs.

The risk score along a two page output and the several questions that are answered as the client goes through the software can be automatically saved in the CRM and saved forever. Therefore, when clients wonder if they were placed into a suitable annuity, life insurance policy, or investment, the Risk Analyzer output can be pulled out to remind clients of the process that you went through to help come up with your recommendations.

The process is vital and a CRM and our Risk Analyzer program are vital cogs in that process (to protect you from lawsuits).