Just as the name indicates, a PFM is a program that helps consumers manage their finances.

OnPointe PFM connects to any financial account a consumer may have: checking, savings, credit cards, investments, loans, retirement plans—you name it.

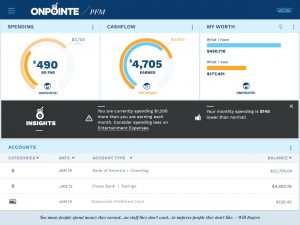

OnPointe PFM automates many aspects of money-management for users because it automatically categorizes spending, which enables users to see exactly how they spend their money.

In essence, OnPointe PFM becomes the daily portal that a user goes to look at “all” of their finances. The program pulls and shows in a very nice looking dashboard:

-Credit card balances and transactions

-Bank/savings account balances and transactions

-Mortgage information (payments and balances)

-Brokerage account balances

-Annuity balances

-Cash value life insurance balances

OnPointe PFM can keep track of every transaction a user makes. It shows users the big picture of their financial status. It can help users budget their money. It can remind the user of upcoming bills.

One really attractive feature of OnPointe PFM is that the moment an account is set up, it sees habits and trends in spending. After a few months’ worth of data, it can be analyzed to help users become more efficient with their spending.

In short, it’s super cool and can be a tremendous value added to tool for advisors to use.

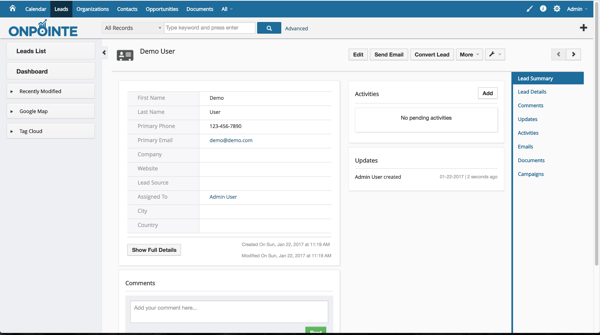

Software integration

OnPointe PFM integrates with OnPointe CRM and OnPointe Financial Planning software. Why is this important? Because with authorization, the client’s data can be automatically uploaded into OnPointe CRM and their financial data uploaded into OnPointe Financial Planning software. This saves advisor hours of time and allows advisors to get to work immediately at analyzing client data and where they need help to grow and protect their wealth for retirement.

Discounted pricing

For certain users, OnPointe software offers up to a 33% discount off our normal rates.